Overview

$25-$49/hr

251 - 300 Employees

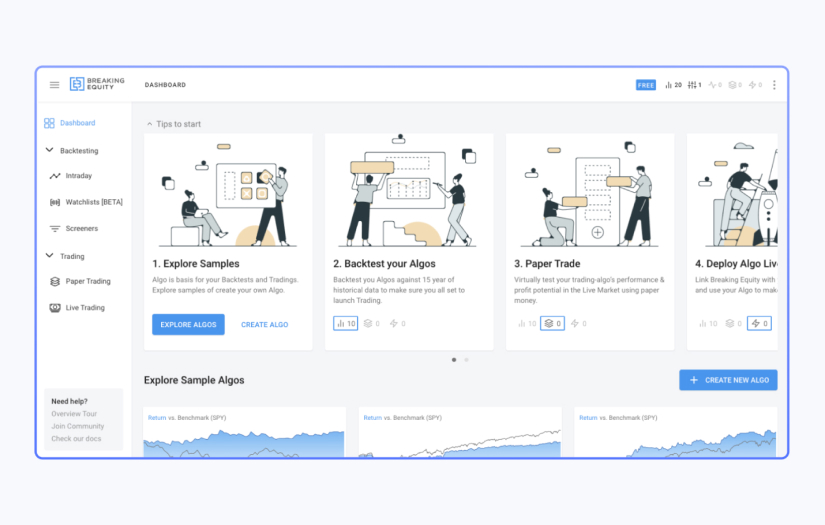

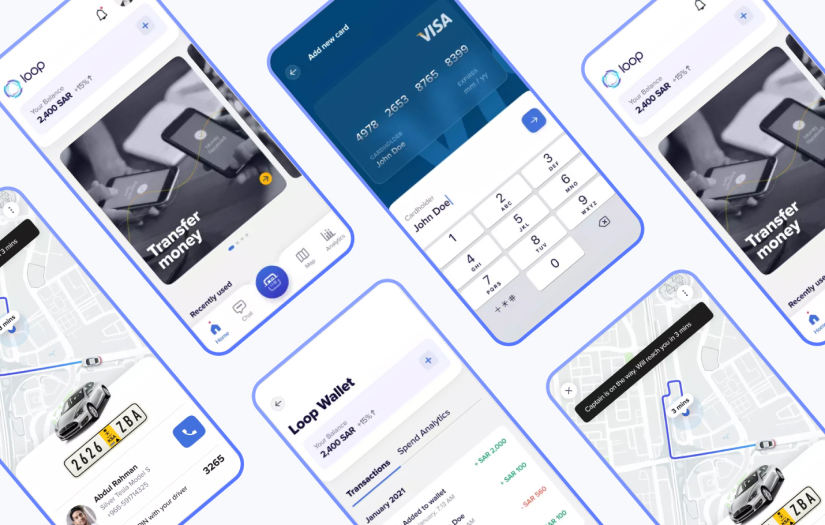

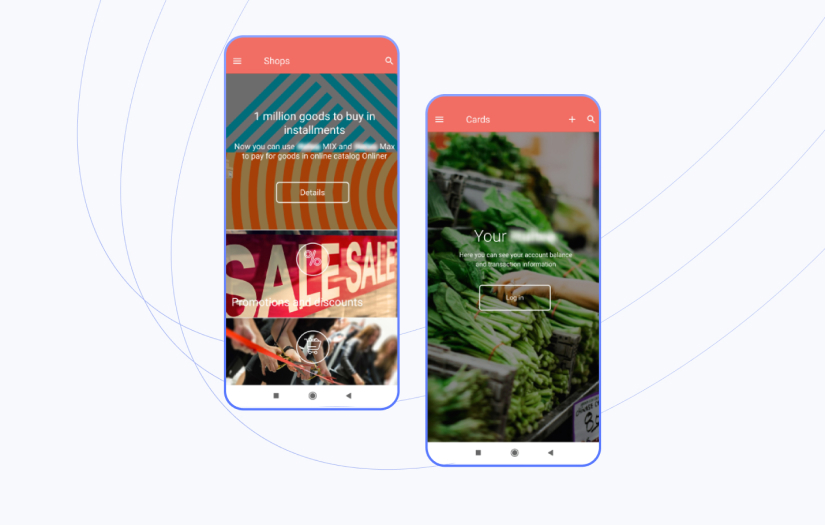

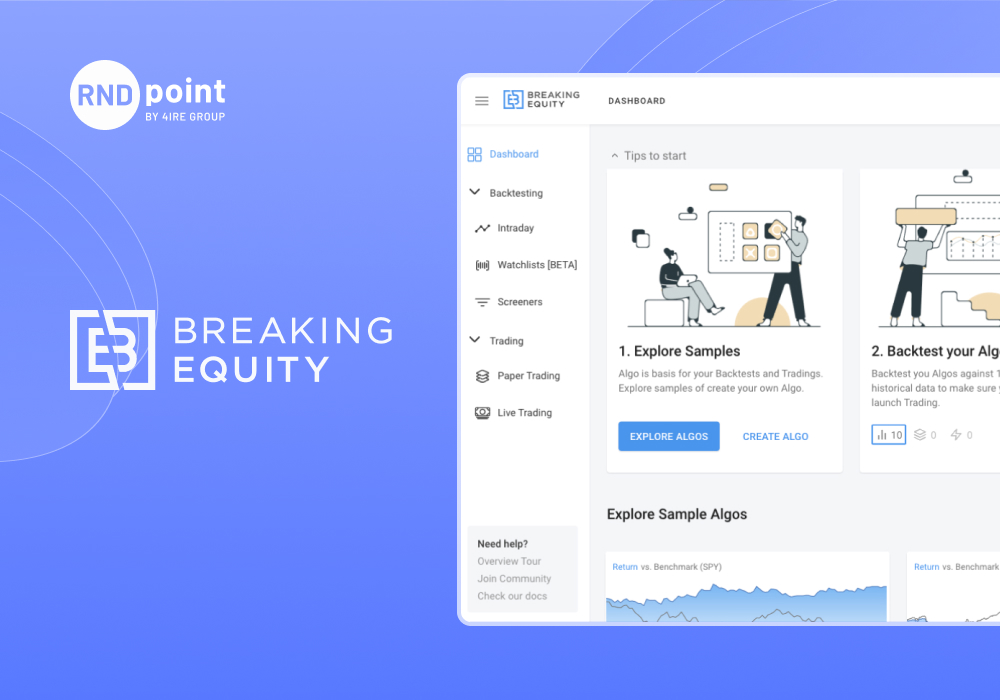

RNDpoint is a global FinTech development services provider. We are a trusted partner of FinTech SMBs and startups, delivering full-cycle assistance with innovative finance projects. Our experts possess in-depth domain-specific expertise, enabling us to lead clients through the FinTech startup pipeline without friction and with fewer risks.

Focus Area

Service Focus

- Mobile App Developers

- Software Developer Company

Industries Focus

- Financial services

Videos

No videos available.

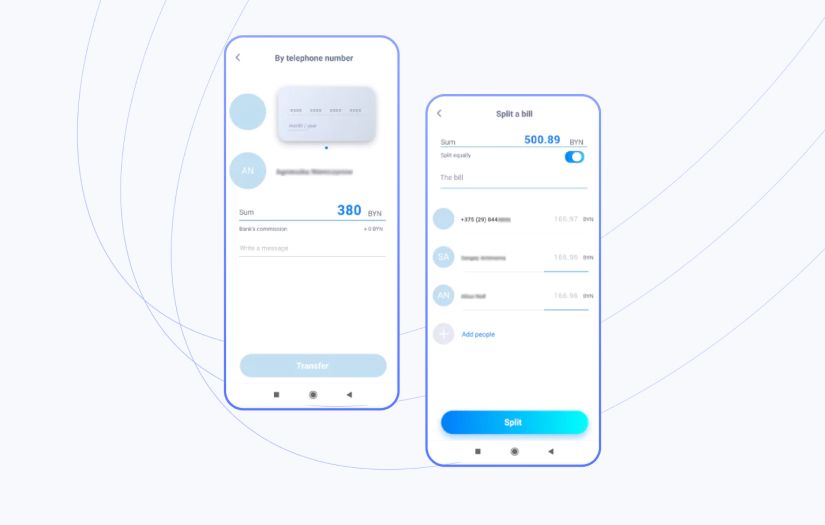

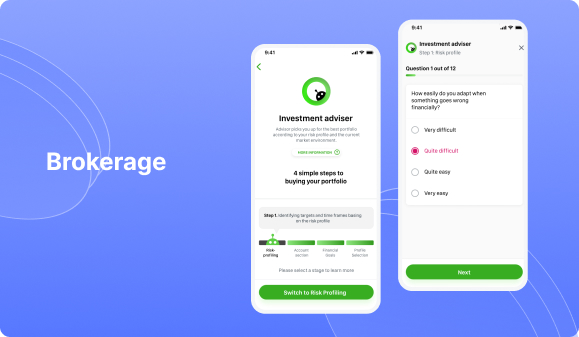

Portfolios

Digital Assets

No resources available.

Reviews

There are currently no reviews for this product.